Understanding What Investors Look for in a Trading Track Record

INVESTOR

6/4/20258 min read

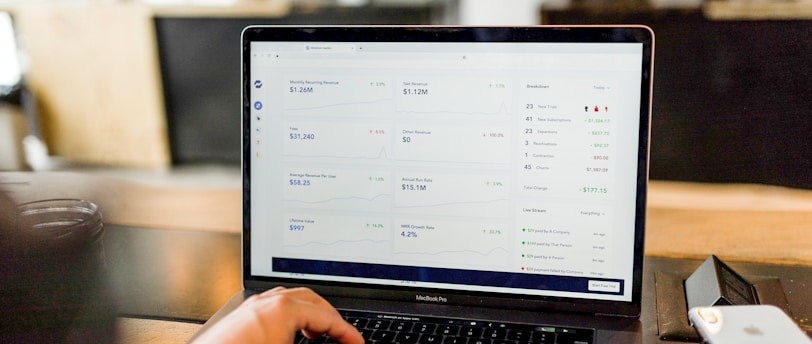

Introduction to Trading Track Records

A trading track record is a comprehensive documentation of a trader's historical performance in financial markets. It serves as a crucial tool for attracting potential investors, offering insights into the trader's capabilities, decision-making processes, and overall market understanding. By presenting a well-documented history of trades, including details such as entry and exit points, profit-loss ratios, and the types of strategies employed, traders can effectively showcase their performance metrics over time.

The significance of a trading track record in securing investor interest cannot be overstated. Investors are inherently risk-averse and seek to limit their exposure to potential losses. A robust trading history can provide them with the confidence they need, suggesting that the trader has the necessary skills and experience to navigate the complexities of financial markets. Demonstrating a consistent track record of successful trading exercises indicates that the trader has not only survived various market conditions but has also managed to prosper during them. Therefore, the nature of a trader’s history becomes a cornerstone for building trust and rapport with prospective investors.

Moreover, trading track records also disclose the trader's risk management approach and adherence to their strategies. A thorough analysis of past trades allows investors to evaluate how the trader responds to market volatility and unexpected events. This aspect is particularly critical, as it highlights a trader's adaptability and decision-making under pressure. Ultimately, a well-prepared and transparent track record not only reflects past performance but serves as an indicator of the trader's future potential, thereby attracting investment from individuals seeking confidence in their trading methodologies.

Key Metrics Investors Analyze

When evaluating a trader's track record, investors look for specific key metrics that provide insight into the trader's performance and risk profile. Among these metrics, drawdown, risk/reward ratio, and overall performance are particularly critical in informing an investor's decision-making process.

Firstly, the drawdown measures the decline from a historical peak in a trader’s account balance until a subsequent peak is reached, representing the potential loss an investor could face during adverse market conditions. Investors pay close attention to the maximum drawdown, which indicates the worst-case scenario in terms of capital erosion. Traders with smaller maximum drawdowns tend to attract more investors, as this suggests a more disciplined trading approach and effective risk management practices.

Secondly, the risk/reward ratio is a vital metric that evaluates the potential reward of a trade relative to the risk incurred. For instance, a risk/reward ratio of 1:3 means that for every dollar risked, the potential gain is three dollars. This ratio helps investors to understand the quality of the trader’s trades. A higher risk/reward ratio often indicates that traders focus on high-potential opportunities, but it also requires a careful assessment of the trade's likelihood of success.

Lastly, overall performance encompasses various aspects, including the win rate, average profit and loss per trade, and consistency over time. This metric reflects how effectively a trader can generate profits and manage losses. Investors tend to prefer traders who demonstrate consistent returns, as this stability suggests not only competence but also a robust strategy supporting their trading decisions.

By analyzing these key metrics—drawdown, risk/reward ratio, and overall performance—investors can gauge the reliability and skill of a trader, ultimately influencing their investment choices.

Understanding Drawdown

Drawdown is a crucial metric in trading that measures the decline in a trader's equity from its highest historical point to its lowest point over a specified period. It quantifies the potential risk that an investor may face and provides insights into a trader's performance during adverse market conditions. Drawdown is typically expressed as a percentage and helps investors assess the vulnerability of a trading strategy. Understanding drawdown is imperative for both traders and their investors, as it can significantly influence decisions based on risk appetite and investment suitability.

To calculate drawdown, one looks at the highest account value (the peak) and determines the difference between this peak and the next lowest point (the trough). The formula can be presented as follows: Drawdown = (Peak - Trough) / Peak. This calculation reflects how much the account value has fluctuated and highlights the maximum loss incurred from that peak. Among different types of drawdowns, peak-to-trough drawdown and maximum drawdown are particularly important. Peak-to-trough drawdown measures the decline from a recent peak to the subsequent trough, providing a momentary snapshot of risk during volatile periods. Conversely, maximum drawdown accounts for the worst historical loss over the lifespan of an investment strategy, presenting a more comprehensive view of potential risk exposure.

Significant drawdowns can severely impact a trader's credibility and influence their future investment opportunities. Investors are generally wary of traders with notable drawdowns as these could imply inadequate risk management strategies. A large drawdown not only diminishes account value but may also undermine confidence among current and prospective investors. Hence, understanding drawdown assists in aligning trading strategies with acceptable risk levels and strengthening overall risk management approaches, fostering a more responsible trading environment.

The Importance of Risk/Reward Ratio

The risk/reward ratio is a critical metric that investors evaluate when assessing a trading track record. This ratio quantifies the potential profit of a trade against its potential loss, providing a snapshot of the risk associated with pursuing a particular investment. A favorable risk/reward ratio can be instrumental in determining whether a trade is worthwhile, as it helps investors identify opportunities that align with their risk tolerance and investment goals.

To calculate the risk/reward ratio, one must first determine the amount of capital at risk, which is the difference between the entry price and the stop-loss price. This figure is then compared to the expected profit, calculated as the difference between the entry price and the target price. For example, if an investor risks $100 to potentially gain $300, the risk/reward ratio would be 1:3. A ratio of this nature suggests that the potential profit is three times greater than the potential loss, making it an attractive proposition for investors.

An optimal risk/reward ratio is typically considered to be 1:2 or higher, depending on the trading strategy and market conditions. Traders who consistently adhere to this principle demonstrate a well-balanced approach towards risk, which is appealing to investors. A practitioner with a history of managing risk effectively indicates a level of expertise that suggests they can navigate market volatility, making them a potentially reliable investment choice. Moreover, understanding this ratio plays a pivotal role in establishing a trader’s credibility; it showcases their strategic thinking and disciplined approach to trading.

By prioritizing a manageable risk/reward ratio, traders can foster long-term success, attracting investors who seek both stability and growth in their trading endeavors. In the dynamic realm of financial trading, a clear understanding of risk/reward dynamics is essential for both traders and investors alike.

Evaluating Long-term Performance

When assessing the value of a trading record, long-term performance emerges as a critical factor. Investors tend to favor consistency in returns over time, prioritizing sustained results rather than fleeting short-term gains. A robust long-term performance not only reflects a trader's ability to adapt to varying market conditions but also serves as a signal of their skill in implementing effective strategies. In essence, the longevity of a trading record is an essential criterion that underpins investor confidence.

Evaluating performance over different time frames provides a more comprehensive view of a trader's capabilities. Typically, performance should be analyzed across various periods—such as one year, three years, five years, and even longer. Short-term gains can be enticing; however, they may not accurately represent a trader's skill, as they could stem from market anomalies or fortunate circumstances. Investors are generally more interested in seeing how a trader performs during various market cycles, including bullish and bearish trends, as well as periods of increased volatility.

A strong long-term track record is characterized by not only positive returns but also risk management strategies that help preserve capital. Investors often seek evidence of a trader’s systematic approach to mitigating risks, as resilience in a portfolio during downturns is as vital as achieving high returns. An analysis of risk-adjusted performance metrics, such as the Sharpe ratio or Sortino ratio, can further illuminate the quality of long-term performance. These metrics allow investors to evaluate how much return has been achieved relative to the risk taken, thereby providing a clearer picture of overall effectiveness.

In summary, the significance of long-term performance cannot be overstated in the realm of trading. It establishes credibility, fosters investor confidence, and signals a trader’s adeptness at navigating complex market landscapes. Therefore, when scrutinizing trading track records, a thorough examination of long-term performance is pivotal for making informed investment decisions.

Risk Management Strategies

Effective risk management strategies are pivotal in the realm of trading, serving as the foundation for any successful trading track record. Investors seek assurance that traders can navigate market volatility while safeguarding their capital. Understanding this principle, traders adopt various approaches to minimize potential losses, which enhances their overall attractiveness to prospective investors.

One fundamental strategy is the implementation of stop-loss orders. This technique allows traders to automatically sell a security when it reaches a predetermined price level. By doing so, they can cap their losses and prevent further financial downturns. For instance, a trader may decide to risk only a specific percentage of their portfolio on a single trade, ensuring that no one losing position adversely impacts their overall trading performance.

Diversification is another critical risk management strategy that involves spreading investments across different assets or markets. By investing in a variety of securities, traders can reduce the impact of a downturn in any one area. This not only helps to stabilize returns but also appeals to investors looking for a more balanced approach to trading risk.

Moreover, traders often employ position sizing to manage risk effectively. Position sizing determines the amount of capital to allocate to each trade based on the trader's risk tolerance and overall trading strategy. By carefully assessing the potential risk-reward ratio, traders can make informed decisions that uphold their trading objectives without exposing themselves to excessive risk.

Lastly, regular performance reviews and evaluations of trading strategies contribute significantly to risk management. Traders who can demonstrate a consistent track record of analyzing their performance, identifying weaknesses, and adjusting their strategies accordingly are more likely to gain the confidence of investors. Ultimately, effective risk management not only fosters sustainable trading practices but also strengthens investors’ trust in a trader’s ability to handle the unpredictable nature of financial markets.

Conclusion: Building a Trustworthy Trading Track Record

In the dynamic world of trading, having a robust and trustworthy trading track record is essential for attracting potential investors. A well-documented track record encompasses detailed statistics on drawdowns, risk/reward ratios, and long-term performance, which together provide a comprehensive view of a trader's capabilities. By understanding these elements, traders can effectively present their trading history in a manner that fosters trust and demonstrates competence.

Drawdowns are particularly critical, as they inform investors about the potential risks associated with a trader's strategies. It is vital for traders to not only monitor these fluctuations but also to communicate them transparently. A thorough explanation of how and why drawdowns occurred can strengthen credibility, as it shows a trader's ability to navigate market challenges while maintaining a level of risk management. This transparency in presenting both the highs and lows builds confidence among potential investors.

Moreover, the analysis of risk/reward ratios also plays a pivotal role. Investors are often keenly interested in understanding the relationship between the risks undertaken and the potential returns. By showcasing favorable ratios, traders can highlight their strategic thinking, reinforcing the notion that they prioritize capital preservation while striving for profitability. This balanced approach, indicating a sound trading philosophy, is a critical element for gaining investor trust.

Lastly, emphasizing long-term performance strengthens the overall narrative of a trader's reliability. Short-term successes may entice interest, but consistent performance over time is what ultimately assures investors of a trader’s expertise. Traders are encouraged to continuously refine their strategies, adapting to evolving market conditions while steadfastly upholding principles of transparency and accountability. By doing so, they can build a trustworthy trading track record that stands out to investors seeking reliable investment opportunities.