Understanding +20% Monthly Gains: The Role of Consistency in Copy Trading Growth

COPY TRADING

6/3/20254 min read

Defining Monthly Gains

Understanding +20% Monthly Gains in Copy Trading: The Importance of Consistency for Sustainable Growth

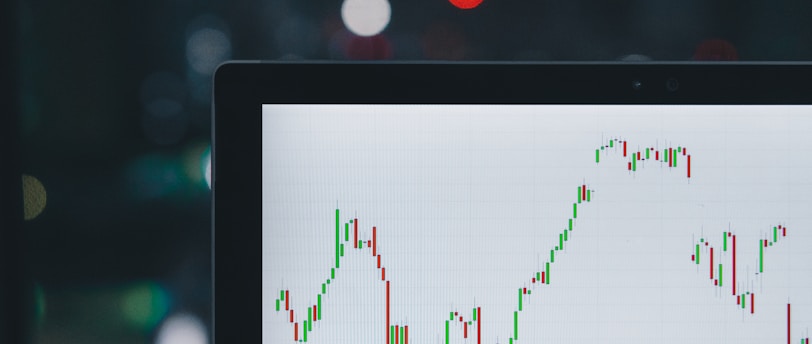

In Copy Trading, monthly performance metrics are essential for evaluating the effectiveness and reliability of a trading strategy over time. These metrics help investors and traders gauge whether a strategy is not only profitable, but also consistent and sustainable. Understanding these figures is key to making informed decisions and managing risk.

One of the most important indicators in copy trading is monthly return, often expressed as a percentage (e.g., +20%). This figure represents the gain or loss on the trading account within a specific month and can serve as a signal of short-term performance and market alignment. However, a high monthly return, such as +20%, must be interpreted in context — particularly in relation to risk exposure, drawdown levels, and long-term consistency.

Achieving +20% in a single month may result from a strong market trend, a high-risk setup, or a successful trading strategy. In the short term, this could reflect a solid trading model, accurate market timing, or effective capital allocation. But reliability over time is what truly builds trust — especially in copy trading, where investors are allocating real capital based on past performance.

Consistency in returns matters more than isolated high-performance months. A trader who consistently generates steady gains, even if lower, is often more attractive than one with high but volatile performance. That’s why copy traders and investors must track metrics like average monthly return, maximum drawdown, and win ratio to assess whether a strategy is sustainable in the long run.

While +20% monthly growth is impressive, it’s important to benchmark this result against the strategy’s risk profile and market conditions. In high-volatility strategies, such returns might be frequent but come with greater risk. In conservative approaches, such growth might be rare — and even exceptional.

Ultimately, in copy trading, a +20% monthly return is not just a performance number — it reflects the strategy’s potential, risk appetite, and capacity for consistent growth. For investors, understanding this context is essential before deciding to allocate capital.

The Importance of Consistency in Copy Trading

In the world of copy trading, consistency often proves more valuable than isolated periods of high returns. While a +20% monthly gain may appear attractive, it’s the trader’s ability to deliver steady, reliable performance over time that builds trust and ensures long-term success — both for themselves and for those copying their strategies.

Consistent results allow copy traders and investors to plan better, manage risk more effectively, and align expectations. Just as in business, sporadic spikes in performance may seem exciting, but they often introduce unpredictability and emotional decision-making, which can undermine long-term capital growth.

A trader who shows stable performance empowers investors to stay invested with confidence. This stability fosters better capital allocation, encourages reinvestment, and allows the development of risk-adjusted strategies — all essential for scalable and sustainable copy trading.

The psychological factor is equally critical. Investors tend to trust and stick with strategies that demonstrate reliability over time. This credibility leads to higher retention rates, stronger communities, and more robust investor-trader relationships — crucial elements in a competitive trading environment.

Conversely, traders who rely on inconsistent, high-risk bursts of profit may attract short-term attention, but often struggle with drawdowns, investor churn, and brand fragility. The volatility may damage reputation and reduce the long-term viability of the strategy.

Ultimately, in copy trading, consistency is not just a performance metric — it’s a signal of professionalism, discipline, and sustainability. It’s what transforms a trading account into an investment-grade strategy others can trust and follow.

Key Strategies to Achieve Consistent Growth

In the copy trading space, consistent performance is the cornerstone of long-term success — both for traders and the investors who follow them. Reaching and maintaining a +20% monthly return isn’t about luck or isolated wins; it requires a disciplined, strategic approach focused on sustainability and trust.

1. Building Investor Confidence and Retention

Just like customer loyalty in business, investor retention is critical in copy trading. Traders who communicate transparently, manage risk responsibly, and deliver steady results are more likely to retain followers over time. Tools such as performance updates, risk explanations, and clear communication channels build credibility and reinforce trust — encouraging investors to stick with the strategy through market cycles.

2. Continuously Improving the Strategy

To drive consistent returns, traders must continuously assess and refine their approach. This includes adapting to market conditions, optimizing entries/exits, and incorporating feedback from investor behavior. Similar to upgrading products in a business, traders who innovate — by testing new strategies, timeframes, or assets — are better equipped to remain competitive and profitable.

3. Leveraging Data and Performance Metrics

High-performing traders rely on analytics and performance metrics to make informed decisions. Monitoring win/loss ratios, drawdown levels, and position sizing helps identify what’s working and what needs adjustment. Platforms like Myfxbook or MQL5 provide deep insights that allow traders to proactively fine-tune their systems and stay aligned with their performance goals.

4. Streamlining Operational Discipline

Consistent performance also depends on operational discipline — following clear risk management rules, avoiding emotional trading, and sticking to a proven system. Much like process optimization in business, refining daily execution habits (entry criteria, stop loss placement, trade frequency) leads to better results over time. This professional mindset is what separates hobbyist traders from those building a scalable copy trading operation.

Conclusion:

In copy trading, achieving +20% in a single month is impressive — but doing it consistently is what builds long-term success. Sustainable growth isn’t about high-risk spikes; it’s about discipline, adaptability, and trust.

Traders focused on steady performance attract more loyal investors, improve risk management, and build credibility. Transparency, regular strategy evaluation, and emotional control are key to scaling responsibly.

Ultimately, consistent growth creates lasting impact, turning a trading strategy into a trusted investment model.